Fill a Valid Icr Illinois Dept Form

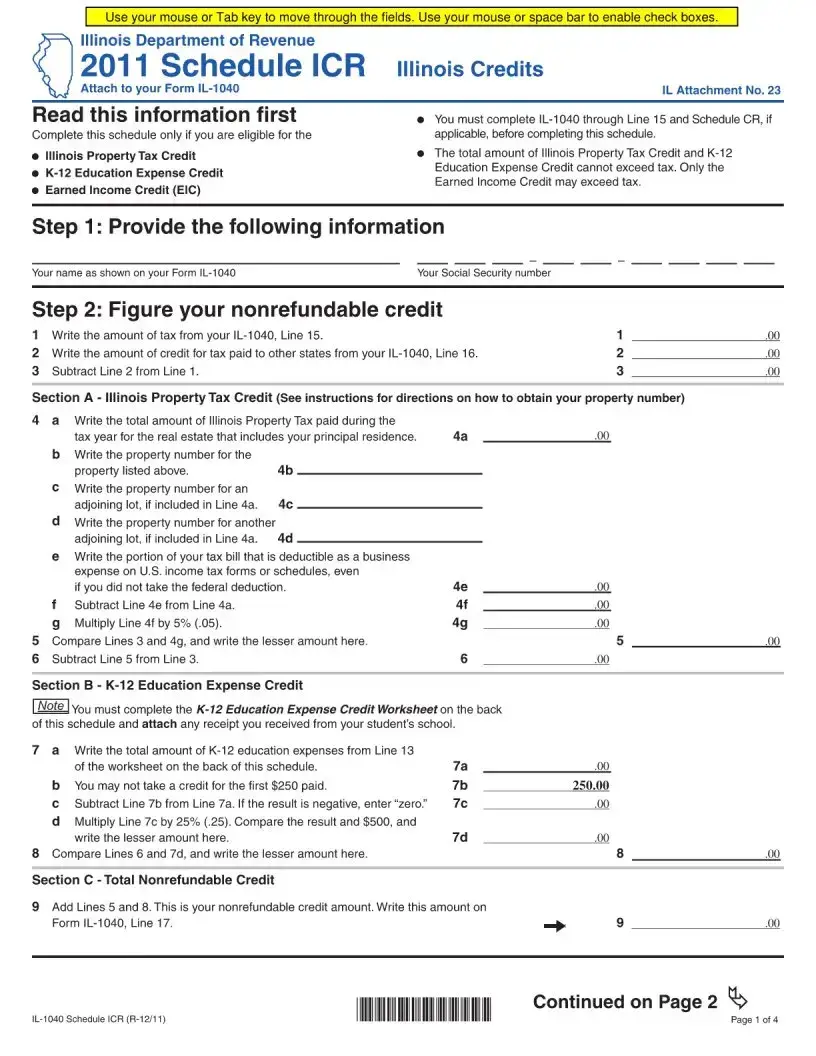

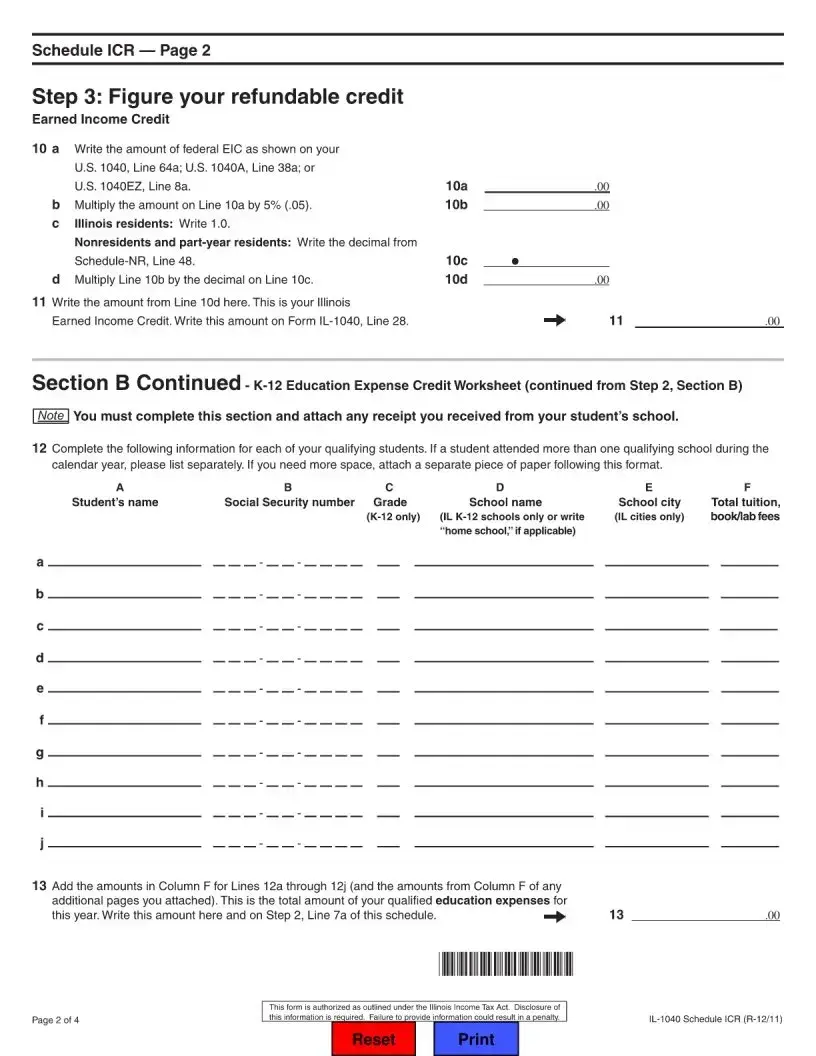

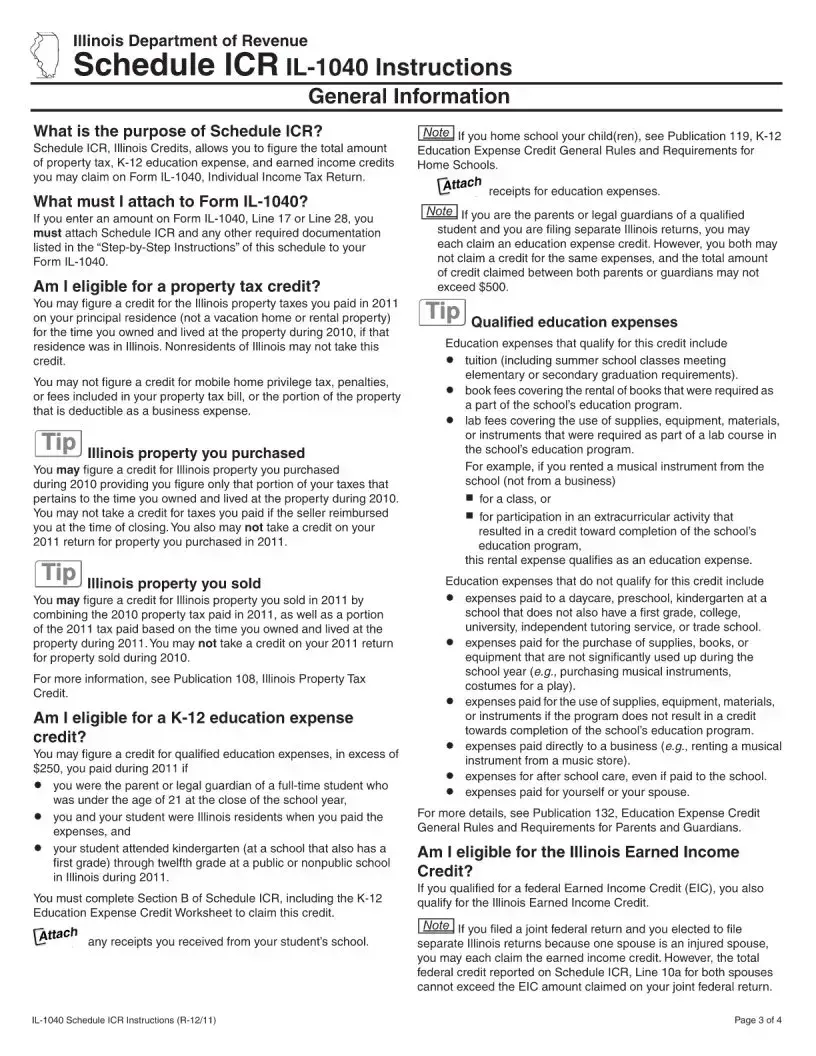

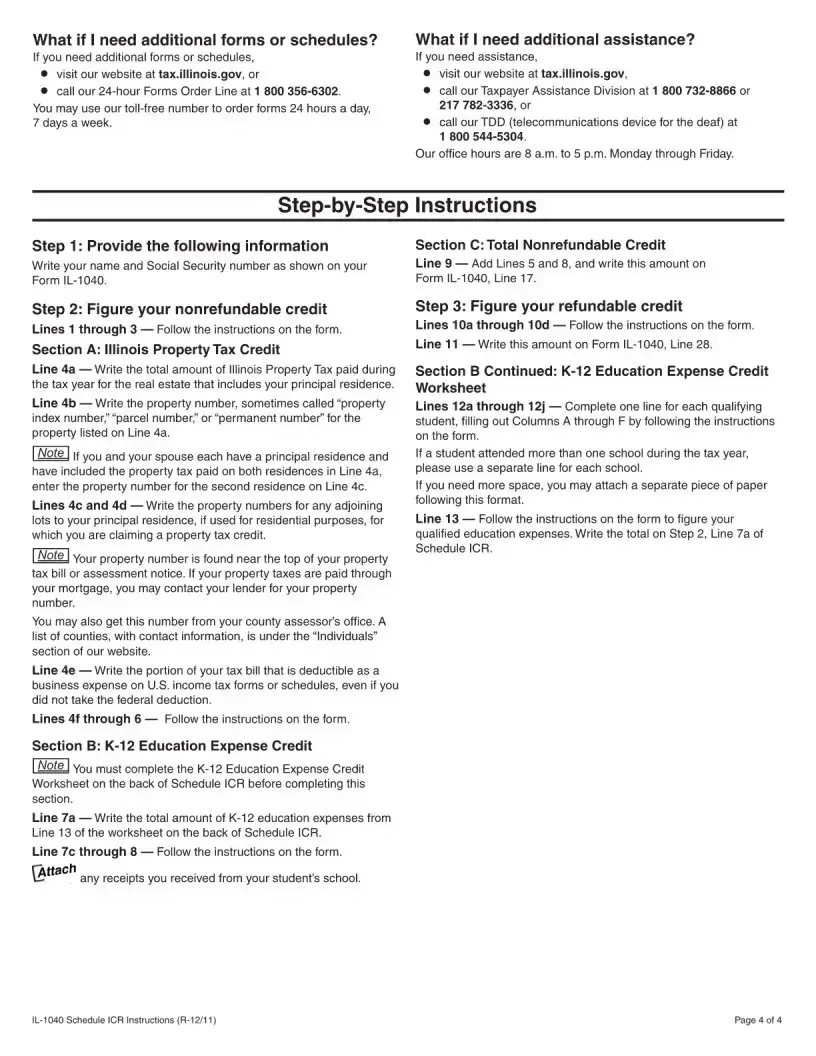

The Illinois Department of Revenue's Schedule ICR is an important tool for taxpayers looking to claim various credits on their state income tax returns. This form specifically caters to individuals eligible for the Illinois Property Tax Credit, K-12 Education Expense Credit, and the Earned Income Credit (EIC). Before diving into the details of the Schedule ICR, it’s essential to complete your Form IL-1040 up to Line 15, as well as Schedule CR if it applies to your situation. The Schedule ICR allows you to calculate both nonrefundable and refundable credits, ensuring you receive the maximum benefit possible. For instance, while the Illinois Property Tax Credit and K-12 Education Expense Credit cannot exceed your total tax, the EIC can. The form guides you through a series of steps, starting with personal information and moving into calculations for each credit type, including specific instructions on how to obtain necessary property numbers and the importance of documenting education expenses. By following the structured approach outlined in the Schedule ICR, you can accurately determine your credits and ensure compliance with state tax regulations.

Example - Icr Illinois Dept Form

Document Breakdown

| Fact Name | Fact Description |

|---|---|

| Form Purpose | This form is used to claim certain tax credits in Illinois, including the Property Tax Credit, K-12 Education Expense Credit, and Earned Income Credit. |

| Eligibility Requirements | To complete this form, you must first fill out Form IL-1040 up to Line 15 and Schedule CR, if applicable. |

| Credit Limits | The total amount for the Illinois Property Tax Credit and K-12 Education Expense Credit cannot exceed your tax amount. Only the Earned Income Credit can exceed your tax. |

| Information Required | You need to provide your name, Social Security number, and details about your property tax and education expenses. |

| Refundable Credits | The form allows for refundable credits, such as the Earned Income Credit, which can provide a refund even if you owe no tax. |

| Governing Law | This form is authorized under the Illinois Income Tax Act, which outlines the requirements for claiming these credits. |

Create More PDFs

What Does Rule to Vacate Mean - The Illinois Vacate Form is an efficient means of conveying lease termination, avoiding ambiguity in landlord-tenant communications.

A Pennsylvania Non-disclosure Agreement (NDA) is a legally binding contract that establishes a confidential relationship between two parties. By signing this agreement, parties ensure that sensitive information shared during their partnership remains protected from disclosure. To safeguard your valuable information, consider filling out the Non-disclosure Agreement form by clicking the button below.

Illinois Business Income Tax - If the corporation has undergone a sale, details such as the date of sale and new owner’s FEIN must be provided on the IL-1120 form.