Fill a Valid Illinois 1120 Form

The Illinois 1120 form, officially known as the Corporation Income and Replacement Tax Return, is a critical document for corporations operating within the state. This form is specifically designed for tax years ending on or after December 31, 2020, and before December 31, 2021. Corporations must adhere to the filing deadlines outlined in the form's instructions. The form requires businesses to provide essential information, including their legal name, mailing address, and federal employer identification number (FEIN). It also includes sections to indicate whether the return is the first or final submission, as well as details regarding any name changes or address updates. Corporations must calculate their income or loss by reporting federal taxable income and making necessary adjustments for various additions and subtractions, such as state and municipal interest income and Illinois special depreciation. Furthermore, the form includes steps to determine the income allocable to Illinois, as well as the calculation of net income, replacement tax, and income tax after credits. Corporations are also required to report any overpayments or balances due, ensuring compliance with state tax regulations. Proper completion of the Illinois 1120 form is essential for accurate tax reporting and to avoid potential penalties for incomplete submissions.

Example - Illinois 1120 Form

Illinois Department of Revenue |

*63512211W* |

|

2021 Form |

|

|

Corporation Income and Replacement Tax Return

See “When should I file?” in the Form

If this return is not for calendar year 2021, enter your fiscal tax year here.

Tax year beginning |

|

|

|

20 |

, ending |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

month day |

|

year |

month day |

|

year |

|||||

This form is for tax years ending on or after December 31, 2021, and before December 31, 2022. For all other situations, see instructions to determine the correct form to use.

Enter the amount you are paying.

$ _______________________

Step 1: Identify your corporation

AEnter your complete legal business name. If you have a name change, check this box.

Name:

BEnter your mailing address.

Check this box if either of the following apply:

•this is your first return, or

•you have an address change.

C/O: |

__________________________________________________ |

|||||

Mailing address: |

___________________________________________ |

|||||

City: |

|

|

State: |

|

ZIP: |

|

CIf this is the first or final return, check the applicable box(es).

First return |

|

|

|

|||

Final return (Enter the date of termination. |

|

|

|

|

|

) |

|

mm dd |

|

yyyy |

|||

DIf this is a final return because you sold this business, enter the date sold

(mm dd yyyy) |

|

|

|

|

|

, and the new owner’s FEIN. |

ECheck the box and see the instructions if your business is a:

Unitary Filer (Combined return) |

Foreign insurer |

FIf you completed the following, check the box and attach the federal

form(s) to this return.

Federal Form 8886

Federal Schedule

Federal Schedule

GApportionment Formulas. Mark the appropriate box or boxes and see

Apportionment Formula instructions. |

Sales companies |

Insurance companies |

Financial organizations |

Transportation companies |

Federally regulated exchanges |

H Check this box if you attached Illinois Schedule UB.

I Check this box if you attached the Subgroup Schedule.

J Check this box if you attached Illinois Schedule

K Check this box if you attached Form

L Check this box if you attached Illinois Schedule M (for businesses). M Check this box if you attached Schedule 80/20.

NEnter your federal employer identification number (FEIN).

OIf you are a member of a group filing a federal consolidated return, enter the FEIN of the parent.

PEnter your North American Industry Classification System (NAICS) Code. See instructions.

QEnter your corporate file (charter) number assigned to you by the Secretary of State.

REnter the city, state, and zip code where your accounting records are kept. (Use the

City |

State |

ZIP |

SIf you are making the business income election to treat all nonbusiness income as business income, check this box and enter zero on Lines 24 and 32.

TCheck your method of accounting.

Cash

Cash

Accrual

Accrual

Other

Other

UIf you are making a discharge of indebtedness adjustment on Form

box and attach federal Form 982 and a detailed statement.

VCheck this box if you attached Schedule INL.

WIf you annualized your income on Form

check this box and attach Form

XCheck this box if your business activity is protected under Public Law

Y Check this box if you are a 52/53 week filer.

Attach your payment and Form

If you owe tax on Line 67, make an electronic payment at Tax.Illinois.gov. If you must mail your payment, complete a payment voucher, Form

Enter the amount of your payment on the top of this page in the space provided.

If a payment is not enclosed, mail this return to: |

If a payment is enclosed, mail this return to: |

ILLINOIS DEPARTMENT OF REVENUE |

ILLINOIS DEPARTMENT OF REVENUE |

PO BOX 19048 |

PO BOX 19038 |

SPRINGFIELD IL |

SPRINGFIELD IL |

|

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this |

IR |

NS |

DR ____ |

Page 1 of 4 |

information is REQUIRED. Failure to provide information could result in a penalty. |

|

|

|

|

|

|

*63512212W*

Step 2: Figure your income or loss |

(Whole dollars only) |

1Federal taxable income from U.S. Form 1120, Line 30.

|

Attach a copy of your federal return. |

|

|

1 |

|

00 |

2 |

Net operating loss deduction from U.S. Form 1120, Line 29a. This amount cannot be negative. |

2 |

|

00 |

||

3 |

State, municipal, and other interest income excluded from Line 1. |

|

|

3 |

|

00 |

4 |

Illinois income and replacement tax and surcharge deducted in arriving at Line 1. |

4 |

|

00 |

||

5 |

Illinois Special Depreciation addition. Attach Form |

|

|

5 |

|

00 |

6 |

|

|

6 |

|

00 |

|

7 |

Distributive share of additions. Attach Schedule(s) |

|

|

7 |

|

00 |

8 |

Other additions. Attach Schedule M (for businesses). |

|

|

8 |

|

00 |

9 |

Add Lines 1 through 8. This amount is your income or loss. |

|

|

9 |

|

00 |

|

|

|

|

|

|

|

Step 3: Figure your base income or loss |

|

|

|

|

|

|

10 |

Interest income from U.S. Treasury and other exempt federal obligations. |

10 |

|

00 |

|

|

11River Edge Redevelopment Zone Dividend subtraction.

Attach Schedule |

11 |

|

00 |

12River Edge Redevelopment Zone Interest subtraction.

|

Attach Schedule |

12 |

|

00 |

|

|

13 |

High Impact Business Dividend subtraction. Attach Schedule |

13 |

|

00 |

|

|

14 |

High Impact Business Interest subtraction. Attach Schedule |

14 |

|

00 |

|

|

15 |

Contribution subtraction. Attach Schedule |

15 |

|

00 |

|

|

16 |

Contributions to certain job training projects. See instructions. |

16 |

|

00 |

|

|

17 |

Foreign Dividend subtraction. Attach Schedule J. See instructions. |

17 |

|

00 |

|

|

18 |

Illinois Special Depreciation subtraction. Attach Form |

18 |

|

00 |

|

|

19 |

19 |

|

00 |

|

|

|

20 |

Distributive share of subtractions. Attach Schedule(s) |

20 |

|

00 |

|

|

21 |

Other subtractions. Attach Schedule M (for businesses). |

21 |

|

00 |

|

00 |

22 |

Total subtractions. Add Lines 10 through 21. |

|

22 |

|

||

23 |

Base income or loss. Subtract Line 22 from Line 9. |

|

23 |

|

00 |

|

4

AIf the amount on Line 23 is derived inside Illinois only, check this box and enter the amount from Step 3, Line 23 on Step 5, Line 35. You may not complete Step 4. (You must leave Step 4, Lines 24 through 34 blank.)

If you are a unitary filer, do not check this box. Check the box on Line B and complete Step 4.

If you are a unitary filer, do not check this box. Check the box on Line B and complete Step 4.

B If any portion of the amount on Line 23 is derived outside Illinois, or you are a unitary filer, check this box and complete all lines of Step 4. (Do not leave Lines 28 through 30 blank.) See instructions.

Step 4: Figure your income allocable to Illinois |

(Complete only if you checked the box on Line B, above.) |

||

24 Nonbusiness income or loss. Attach Schedule NB. |

24 |

|

00 |

25Business income or loss included in Line 23 from

|

or estates. See instructions. |

25 |

|

00 |

|

|

|

||

26 |

Add Lines 24 and 25. |

|

26 |

|

|

00 |

|||

27 |

Business income or loss. Subtract Line 26 from Line 23. |

|

27 |

|

00 |

||||

28 |

Total sales everywhere. This amount cannot be negative. |

28 |

|

|

|

|

|

|

|

29 |

Total sales inside Illinois. This amount cannot be negative. |

29 |

|

|

|

|

|

|

|

30 |

Apportionment Factor. Divide Line 29 by Line 28. Round to six decimal places. |

30 |

|

|

|

|

|

|

|

31 |

Business income or loss apportionable to Illinois. Multiply Line 27 by Line 30. |

|

31 |

|

|

00 |

|||

32 |

Nonbusiness income or loss allocable to Illinois. Attach Schedule NB. |

|

32 |

|

|

00 |

|||

33Business income or loss apportionable to Illinois from

included on a Schedule UB, S corporations, trusts, or estates. See instructions. |

33 |

|

00 |

34 Base income or loss allocable to Illinois. Add Lines 31 through 33. |

34 |

|

00 |

Page 2 of 4 |

Printed by the authority of the state of Illinois. Web only, one copy. |

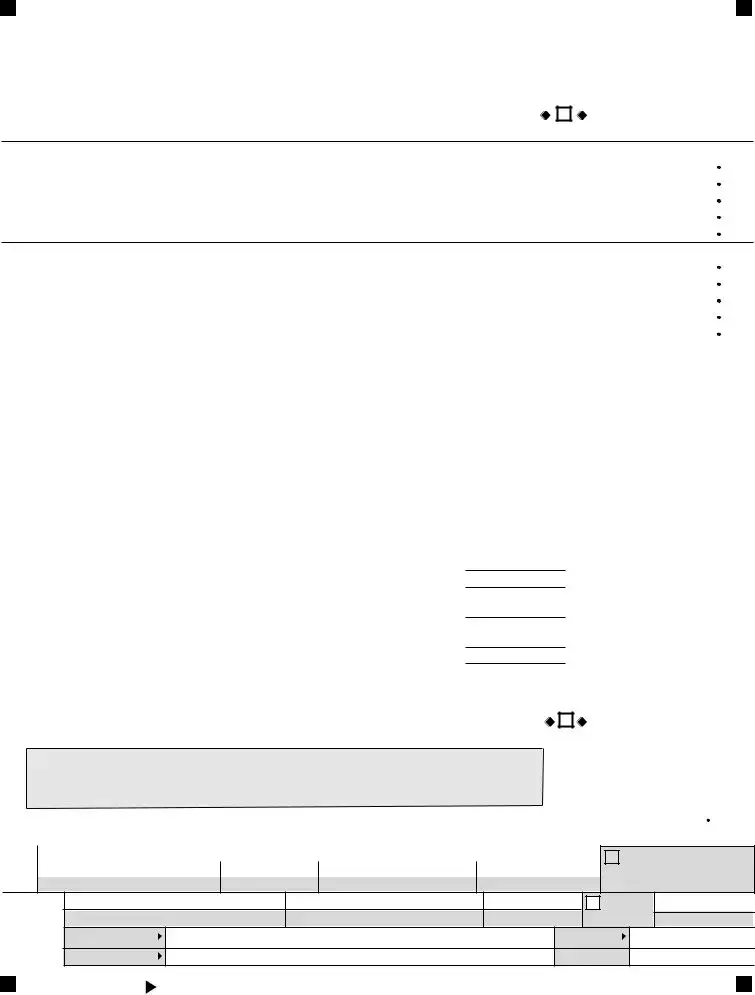

Step 5: Figure your net income

*63512213W*

35Base income or net loss from Step 3, Line 23, or Step 4, Line 34.

36Discharge of indebtedness adjustment. Attach federal Form 982. See instructions.

37Adjusted base income or net loss. Add Lines 35 and 36. See instructions.

38Illinois net loss deduction. If Line 37 is zero or a negative amount, enter zero. Check this box and attach a detailed statement if you have merged losses.

39Net income. Subtract Line 38 from Line 37.

35

00

00

36

00

00

37

00

00

38

00

00

39

00

00

Step 6: Figure your replacement tax after credits

40 |

Replacement tax. Multiply Line 39 by 2.5% (.025). |

40 |

|

00 |

41 |

Recapture of investment credits. Attach Schedule 4255. |

41 |

|

00 |

42 |

Replacement tax before credits. Add Lines 40 and 41. |

42 |

|

00 |

43 |

Investment credits. Attach Form |

43 |

|

00 |

44 |

Replacement tax after credits. Subtract Line 43 from Line 42. If the amount is negative, enter zero. |

44 |

|

00 |

Step 7: Figure your income tax after credits

45 |

Income tax. Multiply Line 39 by 7.0% (.07). |

45 |

|

00 |

|

46 |

Recapture of investment credits. Attach Schedule 4255. |

46 |

|

00 |

|

47 |

Income tax before credits. Add Lines |

45 and 46. |

47 |

|

00 |

48 |

Income tax credits. Attach Schedule |

48 |

|

00 |

|

49 |

Income tax after credits. Subtract Line 48 from Line 47. If the amount is negative, enter zero. |

49 |

|

00 |

|

|

|

|

|

|

|

Step 8: Figure your refund or balance due

50Replacement tax before reductions. Enter the amount from Line 44.

51Foreign Insurer replacement tax reduction. Attach Schedule INS or UB/INS. See instructions.

52Subtract Line 51 from Line 50. This is your net replacement tax.

53Income tax before reductions. Enter the amount from Line 49.

54Foreign Insurer income tax reduction. Attach Schedule INS or UB/INS. See instructions.

55Subtract Line 54 from Line 53. This is your net income tax.

56Compassionate Use of Medical Cannabis Program Act surcharge. See instructions.

57Sale of assets by gaming licensee surcharge. See instructions.

58Total net income and replacement taxes and surcharges. Add Lines 52, 55, 56, and 57.

59Underpayment of estimated tax penalty from Form

60Total taxes, surcharges, and penalty. Add Lines 58 and 59.

61Payments. See instructions.

a |

Credits from previous overpayments. |

61a |

b |

Total payments made before the date this return is filed. |

61b |

c

|

Attach Schedule(s) |

61c |

d |

|

|

|

Attach Schedule(s) |

61d |

e |

Illinois income tax withholding. Attach Form(s) |

61e |

62Total payments. Add Lines 61a through 61e.

63Overpayment. If Line 62 is greater than Line 60, subtract Line 60 from Line 62.

64Amount to be credited forward. See instructions.

Check this box and attach a detailed statement if this carryforward is going to a different FEIN.

65Refund. Subtract Line 64 from Line 63. This is the amount to be refunded.

66Complete to direct deposit your refund.

Routing Number |

|

|

|

|

|

|

|

|

|

|

|

|

Checking or |

|

Savings |

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50

00

00

51

00

00

52

00

00

53

00

00

54

00

00

55

00

00

56

00

00

57

00

00

58

00

00

59

00

00

60

00

00

00

00

00

00

00

00

00

00

00

00

62

00

00

63

00

00

64

00

00

65

00

00

67 Tax due. If Line 60 is greater than Line 62, subtract Line 62 from Line 60. This is the amount you owe. |

67 |

|

00 |

|

|

|

|

|

|

Step 9: Sign below - Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct and complete.

Sign |

|

( |

) |

|

|

Check if the Department |

||

Here |

|

|

may discuss this return with the |

|||||

Signature of authorized officer |

Date (mm/dd/yyyy) Title |

Phone |

paid preparer shown in this step. |

|||||

|

||||||||

Paid |

|

|

|

Check if |

|

||

Print/Type paid preparer’s name |

Paid preparer’s signature |

Date (mm/dd/yyyy) |

Paid Preparer’s PTIN |

||||

Preparer |

|||||||

Firm’s name |

|

Firm’s FEIN |

|

|

|||

Use Only |

|

|

|

||||

|

|

|

|

|

|

||

|

Firm’s address |

|

Firm’s phone |

( |

) |

||

Page 3 of 4 |

Enter the amount of your payment in the space provided on the top of page 1. |

|

|

Attach supporting documents to your Form |

*ZZZZZZZZZ* |

|

|||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||

If you completed: |

Attach: |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

Form |

|

|

U.S. 1120, Pages 1 through 6, or equivalent |

|

||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

Step 1, Line E (unitary) only |

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule UB/Subgroup Schedule |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the box on Form |

|

|

|

|

|

|

Step 1, Line E (foreign insurer) only |

|

|

|

|

|

|

|

|

|

|

Schedule INS |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

Step 1, Line E (unitary) and (foreign insurer) |

|

|

|

|

Schedule UB/Subgroup Schedule and Schedule UB/INS |

|

||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the box on Form |

|

|

|

|

|

|

Step 1, Line F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Form 8886 or Federal Schedule |

|

||||||||

|

|

|

|

|

Step 1, Line U |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Form 982 |

|

||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

Step 1, Line V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule INL |

|

||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

Step 1, Line W |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|

||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

Lines 5 and 18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

Special Depreciation addition |

Check the box on Form |

|

||||||||||||||||||||||||||

|

|

|

|

|

Special Depreciation subtraction |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Lines 6 and 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 80/20 |

|

|||||||||||

|

|

|

|

|

Check the box on Form |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

Lines 7 and 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule(s) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

Distributive share of additions |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Distributive share of subtractions |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Lines 8 and 21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule M and any required support listed on Schedule M |

|

|||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

Other additions |

Check the box on Form |

|

||||||||||||||||||||||||||

|

|

|

|

|

Other subtractions |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Lines 11 through 15 |

|

|

|

|

|

|

|

|

|

|

|

|

Schedule |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

River Edge Redevelopment Zone |

|

|||||||||||||||||||||||||||

|

|

|

|

|

Dividend subtraction |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

River Edge Redevelopment Zone |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Interest subtraction |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

High Impact Business Dividend subtraction |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

High Impact Business Interest subtractions |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Contributions subtraction |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Line 17 |

Foreign Dividend Subtraction |

|

|

|

|

|

|

|

|

Illinois Schedule J, and U.S. 1120, Schedule C or equivalent |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

Lines 24 and 32 |

|

|

|

|

|

|

|

|

|

|

|

Schedule NB |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

Nonbusiness income or loss |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Nonbusiness income or loss allocable to Illinois |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Lines 25 and 33 |

|

|

|

|

|

|

|

|

|

|

Schedule(s) |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

Business income or loss from |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

partnerships, partnerships included on a Schedule UB, |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

S corporations, trusts, or estates |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Business income or loss apportionable to Illinois from |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

Schedule UB, S corporations, trusts, or estates |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Line 36 Discharge of indebtedness adjustment |

|

|

|

Federal Form 982 |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the box on Form |

|

|

|

|

|

|

Lines 41 and 46 Recapture of investment credit |

|

|

|

Schedule 4255 |

|

|||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Line 43 |

Investment credits |

|

|

|

|

|

|

Form |

|

|||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

Line 48 |

Income tax credits |

|

|

|

|

|

|

Schedule |

|

|||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the box on Form |

|

|

|

|

|

|

Lines 51 and 54 Foreign Insurer tax reduction |

|

|

|

Schedule INS or Schedule UB/INS (for unitary filers) |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the box on Form |

|

|

|

|

|

|

Line 59 |

Underpayment of estimated tax penalty |

|

|

Form |

|

|||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you annualized your income on Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

check the box on Form |

|

|

|

|

|

|

Line 61c |

|

|

All Schedules |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

to you |

|

||||||||||||||||||||||||||

|

|

|

|

|

Line 61d |

|

|

All Schedules |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

reported to you |

|

||||||||||||||||||||||||||

|

|

|

|

|

Line 61e Illinois income tax withholding |

|

|

|

|

|

|

|

|

|

|

|

Copies of all Forms |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

**Failure to attach the required documents may result in the disallowance of the corresponding line item.**

Page 4 of 4 |

Document Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The Illinois 1120 form is used by corporations to report income and calculate the replacement tax. |

| Filing Requirement | This form must be filed for tax years ending on or after December 31, 2020, and before December 31, 2021. |

| Governing Law | The form is authorized under the Illinois Income Tax Act. |

| First Return Indicator | Corporations must check a box if this is their first return or if there has been an address change. |

| Payment Instructions | If tax is owed, payments can be made electronically or by mailing a payment voucher, Form IL-1120-V. |

| Required Attachments | Various federal forms and schedules must be attached, depending on the corporation's specific situation. |

| Net Income Calculation | Step 5 of the form is dedicated to calculating net income, which involves several lines to detail income adjustments. |

| Tax Rate | The replacement tax is calculated at a rate of 2.5% on the net income. |

| Penalties for Non-compliance | Failure to provide required information may result in penalties, emphasizing the importance of accurate and complete submissions. |

Create More PDFs

Resale License Illinois - Utilizing the CRT-61 form, Illinois businesses ensure that their resale purchases are properly documented and exempt from sales tax.

The use of a California Divorce Settlement Agreement form is crucial for all parties involved in a divorce, as it clearly defines asset division, child custody, and other key agreements. For those looking to streamline this process, resources like California Templates can provide valuable assistance in creating a thorough and legally sound document.

Foid Card Application Chicago - Questions regarding the applicant’s previous Illinois license or registration discipline history under relevant Acts or administrative rules are included to evaluate professional conduct.

Illinois Gift Tax - Details the requirement for filing within nine months of the decedent's death, pointing out exceptions.