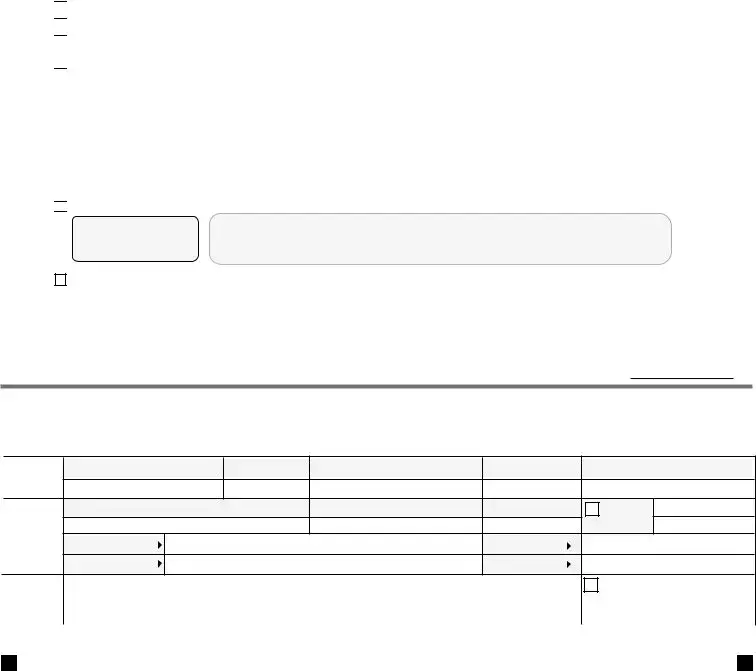

Fill a Valid Illinois Tax Form

The Illinois Tax form, specifically the IL-1040, is a crucial document for residents and part-year residents of Illinois who need to report their individual income tax. This form requires taxpayers to provide personal information, including Social Security numbers for themselves and their spouses, as well as their filing status. Income reporting is a significant aspect, where individuals must enter their federal adjusted gross income and other relevant income details. Exemptions, which can reduce taxable income, are also detailed on the form, allowing for deductions based on age, blindness, and dependents. The calculation of net income and tax liability follows a structured approach, incorporating various credits and potential taxes owed. Additionally, taxpayers can report payments made throughout the year, including withholding and estimated payments, which can affect their refund or amount due. The form ultimately guides users through determining their tax obligations or refunds, ensuring compliance with state tax regulations.

Example - Illinois Tax Form

|

Illinois Department of Revenue |

*60012211W* |

|

|

|

|

|||||

|

2021 Form |

|

|

|

|

|

|

|

|

|

|

|

Individual Income Tax Return |

or for fiscal year ending |

|

|

|

/ |

|

|

|

|

|

Over 80% of taxpayers file electronically. It is easy and you will get your refund faster. Visit tax.illinois.gov.

Step 1: Personal Information Enter personal information and Social Security numbers (SSN). You must provide the entire SSN(s) - no partial SSN.

A Your first name and middle initial |

|

Your last name |

|

|

|

Year of birth |

|

|

Your social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s first name and middle intial |

Spouse’s last name |

|

|

|

Spouse’s year of birth |

Spouse’s social security number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (See inst. if foreign address) |

Apartment number |

City |

|

|

|

|

State |

|

Zip or postal code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign nation if not US (do not abbreviate) |

|

|

County (Illinois only) |

|

Email address |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B Filing status: |

Single |

Married filing jointly |

Married filing separately |

Widowed |

Head of household |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C Check If someone can claim you, or your spouse if filing jointly, as a dependent. See instructions. |

|

You |

Spouse |

|||||||||||

D Check the box if this applies to you during 2021: |

|

Nonresident - Attach Sch. NR |

|

|||||||||||

Staple

Staple your check and

Step 2: Income |

|

|

|

|

(Whole dollars only) |

|

|

|

|

|

|

|

|

||

1 |

Federal adjusted gross income from your federal Form 1040 or |

|

|

1 |

.00 |

|

|

2 |

Federally |

2 |

.00 |

|

|||

3 |

Other additions. Attach Schedule M. |

|

|

3 |

.00 |

|

|

4 |

Total income. Add Lines 1 through 3. |

|

|

4 |

.00 |

|

|

|

|

|

|

|

|

|

|

Step 3: Base Income |

|

|

|

|

|

|

|

5 |

Social Security benefits and certain retirement plan income |

|

|

|

|

|

|

|

received if included in Line 1. Attach Page 1 of federal return. |

5 |

|

.00 |

|

|

|

6Illinois Income Tax overpayment included in federal Form 1040 or

|

Schedule 1, Ln. 1. |

|

|

|

|

|

|

6 |

.00 |

|

|

|

|

7 |

Other subtractions. Attach Schedule M. |

|

|

|

|

7 |

.00 |

|

|

|

|||

|

Check if Line 7 includes any amount from Schedule |

|

|

|

|

|

|

|

|

||||

8 |

Add Lines 5, 6, and 7. This is the total of your subtractions. |

|

|

|

8 |

.00 |

|

||||||

9 |

Illinois base income. Subtract Line 8 from Line 4. |

|

|

|

|

9 |

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 4: Exemptions |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

a Enter the exemption amount for yourself and your spouse. See instructions. |

|

a |

|

.00 |

|

|

|

|||||

|

b Check if 65 or older: |

You |

+ |

Spouse |

# of checkboxes x |

$1,000 |

= |

b |

|

.00 |

|

|

|

|

c Check if legally blind: |

You |

+ |

Spouse |

# of checkboxes x |

$1,000 |

= |

c |

|

.00 |

|

|

|

dIf you are claiming dependents, enter the amount from Schedule

Attach Schedule |

d |

.00 |

|

|

|

Exemption allowance. Add Lines 10a through 10d. |

|

10 |

.00 |

|

|

|

|

|

|

|

|

Step 5: Net Income and Tax

11Residents: Net income. Subtract Line 10 from Line 9.

|

Nonresidents and |

.00 |

|

||||

12 |

Residents: Multiply Line 11 by 4.95% (.0495). Cannot be less than zero. |

|

|

|

|

|

|

|

Nonresidents and |

|

|

12 |

.00 |

|

|

13 |

Recapture of investment tax credits. Attach Schedule 4255. |

` |

13 |

.00 |

|

||

14 |

Income tax. Add Lines 12 and 13. Cannot be less than zero. |

|

|

14 |

.00 |

|

|

|

|

|

|

|

|

|

|

Step 6: Tax After Nonrefundable Credits |

|

|

|

|

|

|

|

15 |

Income tax paid to another state while an Illinois resident. Attach Schedule CR. |

15 |

|

.00 |

|

|

|

16Property tax and

|

Attach Schedule ICR. |

16 |

|

.00 |

|

|

|

17 |

Credit amount from Schedule |

17 |

|

.00 |

|

|

|

18 |

Add Lines 15, 16, and 17. This is the total of your credits. Cannot exceed the tax amount on Line 14. |

18 |

.00 |

|

|||

19 |

Tax after nonrefundable credits. Subtract Line 18 from Line 14. |

|

|

19 |

.00 |

|

|

|

|

|

|

|

|

|

|

Step 7: Other Taxes |

|

|

|

|

|

|

|

20 |

Household employment tax. See instructions. |

|

|

20 |

.00 |

|

|

21Use tax on internet, mail order, or other

|

in the instructions. Do not leave blank. |

21 |

.00 |

22 |

Compassionate Use of Medical Cannabis Program Act and sale of assets by gaming licensee surcharges. |

22 |

.00 |

23 |

Total Tax. Add Lines 19, 20, 21, and 22. |

23 |

.00 |

Printed by authority of the State of Illinois - web only, 1.

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of this information is required. Failure to provide information could result in a penalty.

|

|

*60012212W* |

|

|

|

|

|

||

24 |

24 |

|

|

|

|||||

Total tax from Page 1, Line 23. |

|

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Step 8: Payments and Refundable Credit |

|

|

|

|

|

|

|

|

25 |

Illinois Income Tax withheld. Attach Schedule |

25 |

|

.00 |

|

|

|

|

|

26 |

Estimated payments from Forms |

|

|

|

|

|

|

|

|

|

|

including any overpayment applied from a prior year return. |

26 |

|

.00 |

|

|

|

|

27 |

27 |

|

.00 |

|

|

|

|

||

28 |

28 |

|

.00 |

|

|

|

|

||

29 |

Earned Income Credit from Schedule |

29 |

|

.00 |

|

|

|

|

|

30 |

Total payments and refundable credit. Add Lines 25 through 29. |

30 |

.00 |

|

|

|

|

|

|

Step 9: Total |

|

|

|

|

31 |

If Line 30 is greater than Line 24, subtract Line 24 from Line 30. |

31 |

.00 |

|

32 |

If Line 24 is greater than Line 30, subtract Line 30 from Line 24. |

32 |

.00 |

|

|

|

|

|

|

Step 10: Underpayment of Estimated Tax Penalty and Donations - Only complete Step 10 for

33 |

33 |

|

.00 |

a Check if at least

Check if at least

b Check if you or your spouse are 65 or older and permanently living in a nursing home.

Check if you or your spouse are 65 or older and permanently living in a nursing home.

c Check if your income was not received evenly during the year and you annualized your income on Form

Check if your income was not received evenly during the year and you annualized your income on Form

d Check if you were not required to file an Illinois Individual Income Tax return in the previous tax year.

Check if you were not required to file an Illinois Individual Income Tax return in the previous tax year.

34 |

Voluntary charitable donations. Attach Schedule G. |

34 |

|

.00 |

|

|

35 |

Total penalty and donations. Add Lines 33 and 34. |

|

35 |

.00 |

|

|

|

|

|

|

|

|

|

Step 11: Refund

36If you have an amount on Line 31 and this amount is greater than Line 35, subtract Line 35 from Line 31.

This is your overpayment. |

36 |

.00 |

37 Amount from Line 36 you want refunded to you. Check one box on Line 38. See instructions. |

37 |

.00 |

38I choose to receive my refund by

a

direct deposit - Complete the information below if you check this box.

direct deposit - Complete the information below if you check this box.

You may also contribute |

Routing number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking or |

|

Savings |

||||

to college savings funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here. See instructions! |

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b

paper check.

39 Amount to be credited forward. Subtract Line 37 from Line 36. See instructions. |

39 |

.00 |

|

|

|

|

|

Step 12: Amount You Owe

40 If you have an amount on Line 32, add Lines 32 and 35. - or - |

|

|

If you have an amount on Line 31 and this amount is less than Line 35, |

|

|

subtract Line 31 from Line 35. This is the amount you owe. See instructions. |

40 |

.00 |

Step 13: If this is a joint return, both you and your spouse must sign below.

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Sign |

Your signature |

Date (mm/dd/yyyy) Spouse’s signature |

Date (mm/dd/yyyy) Daytime phone number |

|||

Here |

|

|

|

( |

) |

|

|

|

|

|

|

||

Paid |

Print/Type paid preparer’s name |

Paid preparer’s signature |

Date (mm/dd/yyyy) |

|

Check if |

Paid Preparer’s PTIN |

|

|

|

|

|||

Preparer |

Firm’s name |

|

Firm’s FEIN |

|

|

|

Use Only |

|

|

|

|

||

|

|

|

( |

) |

|

|

|

Firm’s address |

|

Firm’s phone |

|

||

Third |

Designee’s name (please print) |

Designee’s phone number |

|

Check if the Department may |

|

|||

Party |

|

|

|

|

discuss this return with the third |

|

||

|

|

( |

) |

|

||||

Designee |

|

party designee shown in this step. |

|

|||||

|

|

|

|

|

|

|

|

|

Refer to the 2021

.

DR |

|

AP |

|

RR DC IR ID |

Document Breakdown

| Fact Name | Details |

|---|---|

| Form Type | This is the Illinois Individual Income Tax Return (Form IL-1040). |

| Filing Method | Over 80% of taxpayers file this form electronically, which is faster for refunds. |

| Governing Law | This form is authorized under the Illinois Income Tax Act. |

| Personal Information Requirement | Taxpayers must provide complete Social Security numbers for themselves and their spouses. |

| Filing Status Options | Available statuses include Single, Married filing jointly, Married filing separately, Widowed, and Head of household. |

| Exemption Amounts | Exemption amounts vary based on age, blindness, and dependents claimed. |

| Refund Options | Taxpayers can choose to receive refunds via direct deposit or paper check. |

Create More PDFs

Motorist Report Illinois - Keep a copy of the completed Illinois Motorist Report form for personal records after mailing the original to IDOT.

Understanding the importance of a Do Not Resuscitate Order form is crucial for individuals who wish to have their healthcare preferences honored, particularly in emergencies. By utilizing resources such as California Templates, you can easily complete this essential document and ensure that your desires regarding resuscitation are clearly stated and respected. This proactive approach not only safeguards your wishes but also allows your family to focus on what truly matters during difficult times.

Illinois State Id Card - New Illinois Driver's Licenses feature multiple dates of birth placements and a ghost image, raising the bar for security measures.

Intent to Lien Letter Template - It also outlines the legal responsibilities of the property owner to settle the debt and avoid further legal action.