Fill a Valid Illinois Ui Ha Form

The Illinois UI Ha form serves as a crucial tool for household employers to report unemployment insurance contributions for their employees. This form requires detailed information, beginning with the employer’s Illinois Unemployment Insurance Account Number and the Federal Employer's Identification Number (FEIN). Personal identification is essential, as employers must provide their name and address where they wish to receive correspondence. The form also includes sections dedicated to listing household employees, where employers are expected to provide the names and Social Security numbers of each worker. A significant aspect of this form is the requirement to report total wages paid to employees for each quarter, which encompasses various forms of compensation, including salaries, tips, and even non-cash benefits like meals or lodging. Employers must calculate whether their payments exceed the taxable wage base—set at $13,560 for the year 2012—and report any excess amounts accordingly. Additionally, the form includes provisions for calculating the total unemployment insurance contributions due, which are based on the reported wages. Employers must also confirm the number of employees covered under unemployment insurance and provide a signature to validate the report. Completing the UI Ha form accurately is vital, as failure to file correctly may lead to penalties and interest, underscoring the importance of understanding each section thoroughly.

Example - Illinois Ui Ha Form

You may file

Step 1

Line 1a Enter your

Line 1b Enter the nine digit Federal Employer's Identification number (FEIN) assigned to you by the Internal Revenue Service.

Line 2 Enter your first name, middle initial and last name.

Line 3 Enter the street address including the city, state and zip code where you want to receive this form.

Step 2

Lines 6 through 14 - use one line for each employee

Column A

Print the last and first name(s) of your household employee(s).

Column B

Complete this item by copying your employee’s social security number from his or her Social Security card.

Columns C through F (quarters)

Enter the total wages paid to each employee for each quarter of the year. If no wages were paid for that quarter, please enter "0".

Wages include (a) salaries, commissions and bonuses, tips reported to the employer, separation pay, vacation pay, prizes, sick pay, payments on account of retirement; (b) the reasonable cash value of remuneration paid other than cash, such as goods, meals and lodging; and (c) any remuneration for services performed within the State which is considered wages under the Federal Unemployment Tax Act.

Line 15 If you had more than eight household employees during 2012, use an additional sheet of paper and include the information in Step 2 for each additional worker. Total each Column C through F on the attachment, and write the totals on Line 15 in the appropriate column.

Line 16a Add Lines 6 through 15 within each column. This is the total wages paid for each quarter.

Step 3

Line 16b Copy totals from line 16a above.

Line 17 Write in the total wages paid in excess of the unemployment insurance taxable wage base amount for each worker. For 2012, the taxable wage base amount is $13,560 for each worker.

An employer must pay unemployment insurance contributions on only the first $13,560 in wages for each employee.

Example: You have one household employee that you pay $5,000 each quarter. During the first and second quarter, the wages paid to the employee total $10,000, so you would enter “0” in each column for the first and second quarters. During the third quarter, the total amount paid to the employee reaches $15,000 which exceeds the $13,560 unemployment insurance taxable wage base by $1,440. So the amount to be entered on Line 17 for the third quarter, is $1,440

|

1st quarter |

2nd quarter |

3rd quarter |

4th quarter |

|

|

|

|

|

Ex Line 17 |

$ 0 |

$ 0 |

$1,440 |

$5,000 |

|

|

|

|

|

Step 3 continued

Line 18 Subtract Line 17 from Line 16b and enter the result on Line 18. These are your taxable wages.

Lines 19 and 20

For each quarter, calculate your unemployment insurance contribution. Within each column, complete either Line 19 or 20, whichever is applicable.

Line 21 Quarter totals: Enter the amount from Line 19 or 20 in each column. This is your contribution due for each quarter.

Line 22. Grand total. Add the quarterly totals from Line 21 (Columns C, D, E and F) and enter the result on Line 22. This is your 2012 total

unemployment insurance contributions due.

Step 4

Line

each month of the quarter. Include workers who have earned more than $13,560 in the calendar year and those on vacation or paid

sick leave. Exclude workers on strike.

Step 5

Line 27 Write the amount shown on line 22. This is your total 2012 unemployment insurance contribution.

Line 28 Write the amount of any previous payment made to the Illinois Department of Employment Security for the liability shown on Line 27.

Line 29 Subtract Line 28 from Line 27.

This is the amount of unemployment insurance contribution due.

Make your check payable to the Illinois Department of

Employment Security.

Step 6

Line 30 If you have stopped employing workers, write the date of the last day you employed workers.

Step 7

Line 31 This report must be signed by the person named in Step 1, Line 2. If signed by any other person, a Power of Attorney must be attached.

MAIL YOUR COMPLETED REPORT ALONG WITH YOUR CHECK TO:

ILLINOIS DEPARTMENT OF EMPLOYMENT SECURITY PO BOX 3637

SPRINGFIELD IL

General Instructions

What if I do not file or pay by the due date?

If you do not file a processable return or pay the tax you owe by the due date, you will owe penalty and interest.

What if I need to correct information I reported? Where may I obtain help or more information?

For other related forms or help with questions regarding unemployment insurance, please call the Unemployment Insurance Hotline

The TTY number for the hearing impaired is (866)

State of Illinois

Form

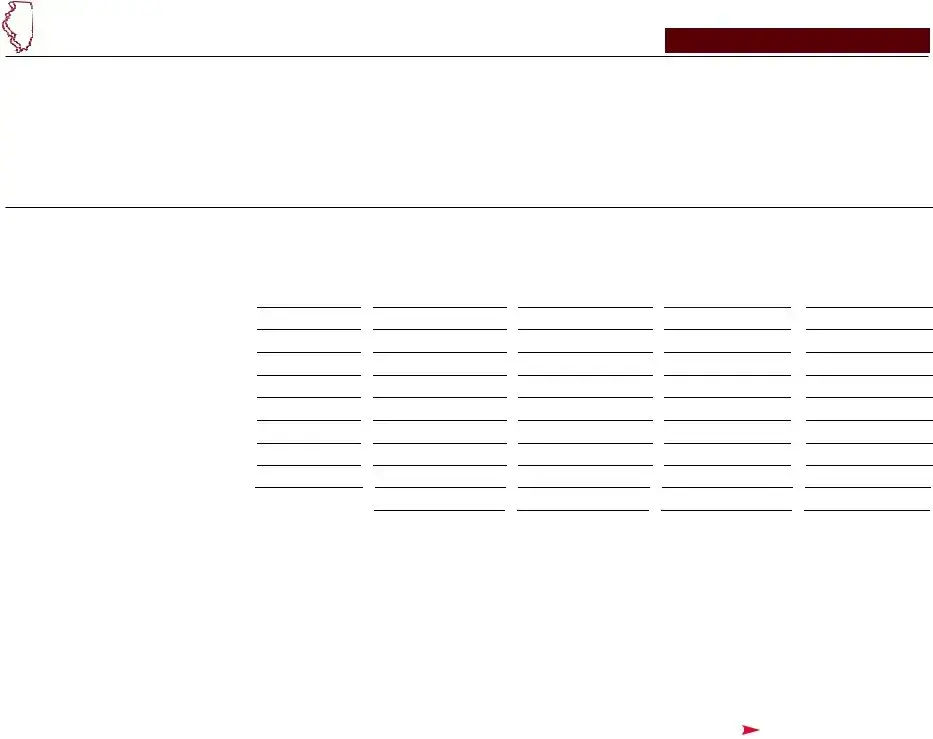

Step 1: Tell us about yourself

Illinois Department of Employment Security

File

1a ________________________________ b ___

Illinois account number (Unemployment Insurance) |

Federal employer’s identification number |

|

2___________________________________________________________________

Your name (first, middle initial, last)

3___________________________________________________________________

Street Address

___________________________________________________________________

City |

State |

Zip |

Step 2: Report your household employee information

5For unemployment insurance reporting, complete Columns

6 |

A |

|

B |

|

C |

|

D |

|

E |

|

F |

|||||

|

Name |

Social |

1/2012 |

|

2/2012 |

|

3/2012 |

|

4/2012 |

|

||||||

|

(last, first) |

Security No. |

|

QTR. ending Mar. 31 |

|

QTR. ending June 30 |

|

QTR. ending Sept. 30 |

|

QTR. ending Dec. 31 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

7 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

8 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

9 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

10 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

11 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

12 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

13 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

14 |

_____________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

15 |

Other (attach) ________________________ |

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||

|

• |

• |

|

• |

|

• |

|

• |

|

• |

||||||

|

|

|

|

|

|

• |

|

• |

|

• |

|

• |

||||

16a Column totals: Add Lines 7 through 15 in each column |

|

|

• |

|

• |

|

• |

|

• |

|||||||

|

|

• |

|

• |

|

• |

|

• |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 3: Figure your unemployment insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

contribution due for each quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

1st quarter |

|

|

2nd quarter |

|

|

3rd quarter |

|

|

4th quarter |

|

||

16b Column totals: Copy totals from line 16a above. |

|

|

______________________ |

______________________ |

______________________ |

_____________________ |

||||||||||

17Write the total wages paid in excess of the taxable

|

wage base amount ($13,560 per employee for 2012). |

______________________ |

______________________ |

______________________ |

_____________________ |

||

18 |

Subtract Line 17 from Line 16b. |

______________________ |

______________________ |

______________________ |

_____________________ |

||

19 |

If Line 16a is less than $50,000, multiply Line 18 by |

______________________ |

______________________ |

______________________ |

_____________________ |

||

|

your 2012 contribution rate or 5.400%, whichever is less. |

|

|

|

|

|

|

20 |

If Line 16a is $50,000 or more, multiply Line 18 by |

______________________ |

______________________ |

______________________ |

_____________________ |

||

|

your 2012 contribution rate. |

|

|

|

|

|

|

21 |

Quarter totals: Enter the amount from Line 19 and/or 20. |

______________________ |

______________________ |

______________________ |

_____________________ |

||

22 |

Grand total: Add the quarter totals from Line 21 (Columns C, D, E and F) and write the result on Line 22. |

|

|

22 |

_________________ |

||

PLEASE RETURN THIS PAGE AND PAGE 2 OF THIS FORM |

|

||||||

Step 4: Number of employees who are covered for unemployment insurance

Write the total number of covered workers (full and part time) who performed services during or received pay for the payroll period including the 12th of each month of each quarter. If none, write “0”

23 |

1st quarter |

A |

January 12 |

__________ |

B |

February 12 |

__________ |

C |

March 12 |

___________ |

24 |

2nd quarter |

A |

April 12 |

__________ |

B |

May 12 |

__________ |

C |

June 12 |

___________ |

25 |

3rd quarter |

A |

July 12 |

__________ |

B |

August 12 |

__________ |

C |

September 12 |

___________ |

26 |

4th quarter |

A |

October 12 |

__________ |

B |

November 12 |

__________ |

C |

December 12 |

___________ |

Step 5: Figure your total unemployment insurance contribution due

27 |

Write the amount from Line 22. |

27 |

____________I ____ |

|

28 |

Write the amount of any previous payment to the Illinois Department of Employment Security for the liability shown on Line 27. |

28 |

____________I ____ |

|

29 |

Subtract Line 28 from Line 27. Make your check payable to the Illinois Department of Employment Security. |

29 |

____________I ____ |

|

|

|

|

|

|

Step 6: Complete if you are no longer employing workers |

|

|

|

|

30 |

Write the date you stopped employing workers. |

30 |

____/_____/____ |

|

|

|

|

month day year |

|

|

|

|

|

|

Step 7: Sign below

Under penalties of perjury, I state that I have examined this report and, to the best of my knowledge, it is true, correct, and complete.

31 ____________________________________________________________ |

____/____/__________ |

(_____) ______________ |

|

Household employer’s signature (full name) |

month day |

year |

Daytime telephone number |

Filing deadline: April 15, 2013

You may file and pay

Mail your completed report along with your check to:

ILLINOIS DEPARTMENT OF EMPLOYMENT SECURITY

PO BOX 3637

SPRINGFIELD IL

This state agency is requesting information that is necessary to accomplish the statutory purpose as outlined under 820

PLEASE RETURN THIS PAGE AND PAGE 1 OF THIS FORM

Document Breakdown

| Fact Name | Description |

|---|---|

| Account Number Requirement | Employers must enter their 7-digit Illinois Unemployment Insurance Account Number on the form. |

| FEIN Requirement | The form requires the nine-digit Federal Employer's Identification Number (FEIN) assigned by the IRS. |

| Employee Information | Employers need to provide the names and Social Security numbers of their household employees. |

| Wage Reporting | Total wages paid to each employee for each quarter must be reported, including various forms of compensation. |

| Taxable Wage Base | For 2012, the taxable wage base is $13,560 per employee, and contributions are due only on wages up to this amount. |

| Filing Deadline | Employers are encouraged to file online by the due date to avoid penalties and interest on unpaid contributions. |

Create More PDFs

Can I Send My Child to a Different School District - A document confirming a student's good standing and updated medical records for school transfer within Illinois.

To facilitate the divorce process, it is important to utilize resources like the California Templates, which provide guidelines for completing the California Divorce Settlement Agreement form accurately and effectively, ensuring that all terms related to asset division and custody arrangements are clearly documented.

File Itr Online - The ITR-1 includes a section for specifying the types of taxes the clearance is requested for, including business and individual taxes.